When your roof sustains damage from storms, hail, or wind, the next step in the insurance claim process is an inspection by an insurance adjuster. Understanding what insurance adjusters look for on roofs can help you prepare for the process, increase the chances of a successful claim, and even maximize your insurance payout.

In this guide, we’ll cover what adjusters inspect, how to get homeowners insurance to pay for a roof replacement, and what factors influence your claim.

What Do Insurance Adjusters Look for on Roofs?

When an adjuster inspects a roof, they focus on signs of damage, wear, and structural integrity. Here are the key areas they evaluate:

1. Evidence of Storm Damage

Adjusters look for damage caused by hail, wind, heavy rain, and fallen debris. This can include:

- Hail impact marks on shingles, flashing, and vents.

- Wind damage, such as missing or creased shingles.

- Water damage, including leaks and moisture intrusion.

- Fallen tree limbs or debris damage.

2. Shingle Condition and Lifespan

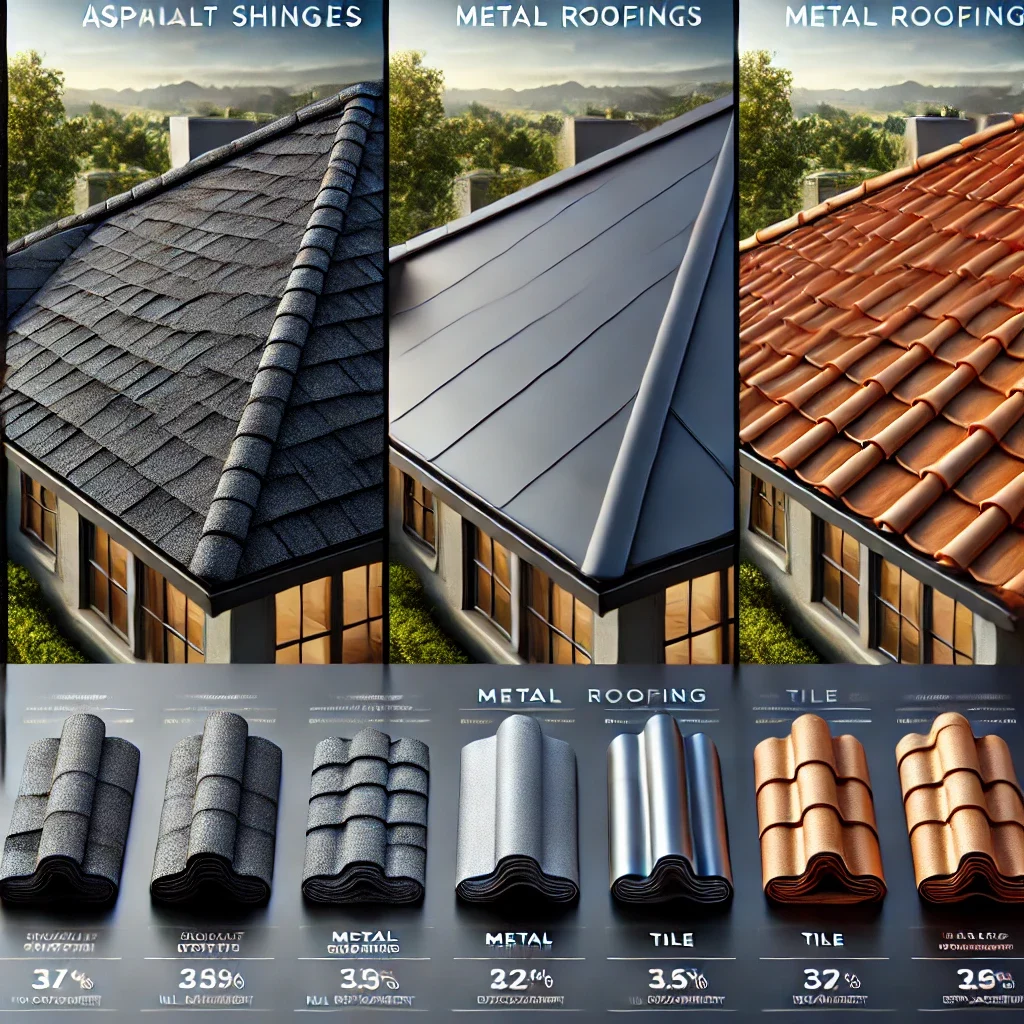

If your shingles are brittle, cracked, or curling, the adjuster may determine that your roof has reached the end of its lifespan. Different roof types for insurance have varying levels of coverage, with asphalt shingles typically having a shorter lifespan than metal or tile roofs.

3. Roof Age and Previous Repairs

Older roofs (15+ years) are more likely to be deemed ineligible for full replacement. Adjusters also check for previous repairs and whether they were done properly. A roofing certificate of completion for insurance can sometimes be required to prove recent work was done by a professional roofing contractor.

4. Structural Integrity and Safety Risks

A roof with sagging areas, soft spots, or exposed underlayment could be marked as a safety hazard, increasing the likelihood of a replacement approval.

How to Get Insurance to Pay for Roof Replacement

If your roof has significant damage, you’ll want to maximize your chances of getting insurance to cover a full roof replacement. Follow these steps:

- Get a Professional Roof Inspection for Insurance Claims – Before filing, hire a local roofer (like Allegiant Roofers) to assess the damage and provide documentation.

- Document the Damage – Take high-quality photos and videos of damaged areas, including missing shingles, dents, and leaks.

- File Your Claim Promptly – Most insurance companies have a limited window for reporting storm damage.

- Be Present for the Adjuster’s Inspection – Having your roofing contractor present ensures that nothing is overlooked.

- Request a Second Inspection If Needed – If your claim is denied or the payout is too low, you can request a reinspection with additional evidence.

Average Insurance Payout for Hail Damage Roof

The average insurance payout for roof hail damage roof claims varies based on several factors, including roof type, age, and coverage level. Here’s a breakdown:

| Roof Type | Average Payout | Coverage Considerations |

| Asphalt Shingles | $5,000 – $15,000 | Most common, but depreciation applies to older roofs |

| Metal Roof | $10,000 – $30,000 | More durable, often covered fully if damage is severe |

| Tile Roof | $15,000 – $50,000 | High replacement cost, but typically covered if broken |

| Flat Roof | $8,000 – $25,000 | Requires detailed inspections for leaks |

Roof Types for Insurance: What Matters?

The type of roofing material on your home significantly impacts insurance coverage. Here’s what you need to know:

- Asphalt Shingles – Most common, but older shingles may receive reduced payouts.

- Metal Roofs – More resistant to damage, but costly to replace.

- Slate or Tile Roofs – Long-lasting but expensive; coverage depends on policy specifics.

- Wood Shingles – Prone to fire risk, sometimes not covered by standard policies.

Roofing Certificate of Completion for Insurance

If your roof is replaced or repaired, some insurance companies require a roofing certificate of completion for insurance. This document proves the work was done by a licensed contractor and meets local building codes. Failing to provide this certificate could delay your claim.

FAQ: Common Questions About Insurance Roof Inspections

How long does an insurance roof inspection take?

Most inspections last 30 minutes to an hour, but complex cases may take longer.

What if my insurance claim is denied?

You can appeal by providing additional documentation, hiring a public adjuster, or requesting an independent inspection.

Will my insurance rates go up if I file a claim for roof damage?

It depends on your policy and insurer. Some companies increase premiums after claims, while others do not.

Can I choose my own roofing contractor for repairs?

Yes! Insurance companies may recommend contractors, but you have the right to choose your own trusted roofer, like Allegiant Roofers.

Conclusion

Understanding what insurance adjusters look for on roofs can make a significant difference in getting your claim approved. By preparing in advance, documenting damage, and working with a trusted roofing company, you can navigate the claims process successfully. If you need expert guidance on your roof inspection for insurance, contact Allegiant Roofs—we’re your trusted local roofing experts in Cincinnati and Dayton.